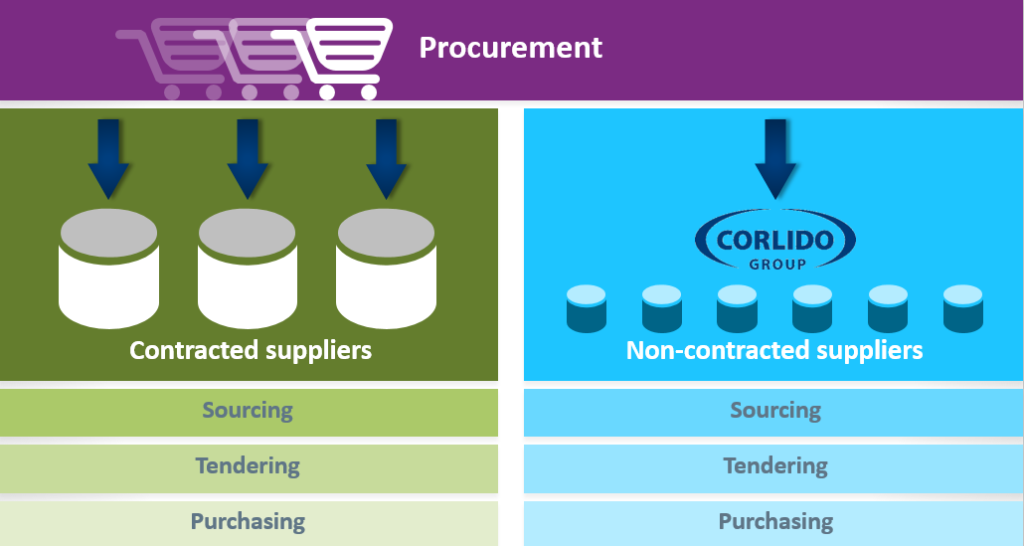

OFF-CONTRACT SPEND MANAGEMENT (TAIL SPEND)

GET CLARITY ON YOUR TAIL SPEND WITH A SINGLE SUPPLIER

Through active years of serving some of the worlds prestigious companies, we developed the single creditor model in managing your pool of C-Class suppliers.

Low value spend tend not to be actively managed. It consists of small portions of spend usually between 10-20%, but large number of suppliers are responsible. It usually accounts for 80% of the total transaction, making up about 20% of company’s spend by volume.

YOUR TAIL SPEND IN ONE PROVIDER

The 80/20 rule or the Pareto principle: Procurement departments always have more incentive to focus on large, multi-year contracts because of the larger savings realized. Yet this leads companies to basically ignore almost 20% of their budget. This unmanaged spend is a more traditional definition of tail spend and is typically considered the 80% of transactions that constitute 20% of a company’s spend, otherwise known as the Pareto principle. Some organizations may be at 70/30 or 90/10 but the pattern is generally the same.

Managing your 20% to unlock its hidden benefits is what we represent to you. Such costs are usually:

- Off-Contract

- Low value/volume

- Maverick

- Spot buys

- Uncontrolled

Simplify your non-contractual purchases with COPS

A simple one-stop place with consolidated catalogues of trusted manufacturers bring you endless products at the press of a button.

Tail spend automated in COPS

The single tool for your entire tail spend, access to an endless list of products. This can be customized to your specification

BENEFITS

- One supplier managing multiple (Single creditor model)

- Invoice and supplier base reduction by up to 80%

- More time for strategic procurement

- Get a grip on the overlooked cost

- Decrease internal cost up to 20%

WHAT OUR PARTNERS SAY

- Easy to implement and very convenient.

- Reduction of invoices and suppliers by up to 80%

- Ample time for strategic planning

- Control over what was ad-hoc previously

- Decline in internal cost up to 20%

ADVANTAGES OF THE SINGLE CREDITOR

- One supplier managing several vendors.

- Decline in invoice and supplier base of up to 80%

- Drop in internal cost.

- Ample time for strategic procurement.

RELATED SPECIALTies

CONTACT US BELOW FOR FURTHER DISCUSSION ON THE SINGLE CREDITOR MODEL

Mail us : support@lynchcapitalgh.com

Call us : +233 30 331 3825

Or leave your contact, we will call you back

OUR CLIENTS